Before you begin the home-buying process, it is essential to check your credit rating. If you’ve been a little inconsistent in the past about keeping up with credit card bills or ever had a letter from a debt collector, this could affect your chances of obtaining a mortgage or getting the best interest rate on your borrowing. Read on to discover why keeping your credit rating in good condition is one of the most important things you need to do before starting a purchase.

What is a credit rating?

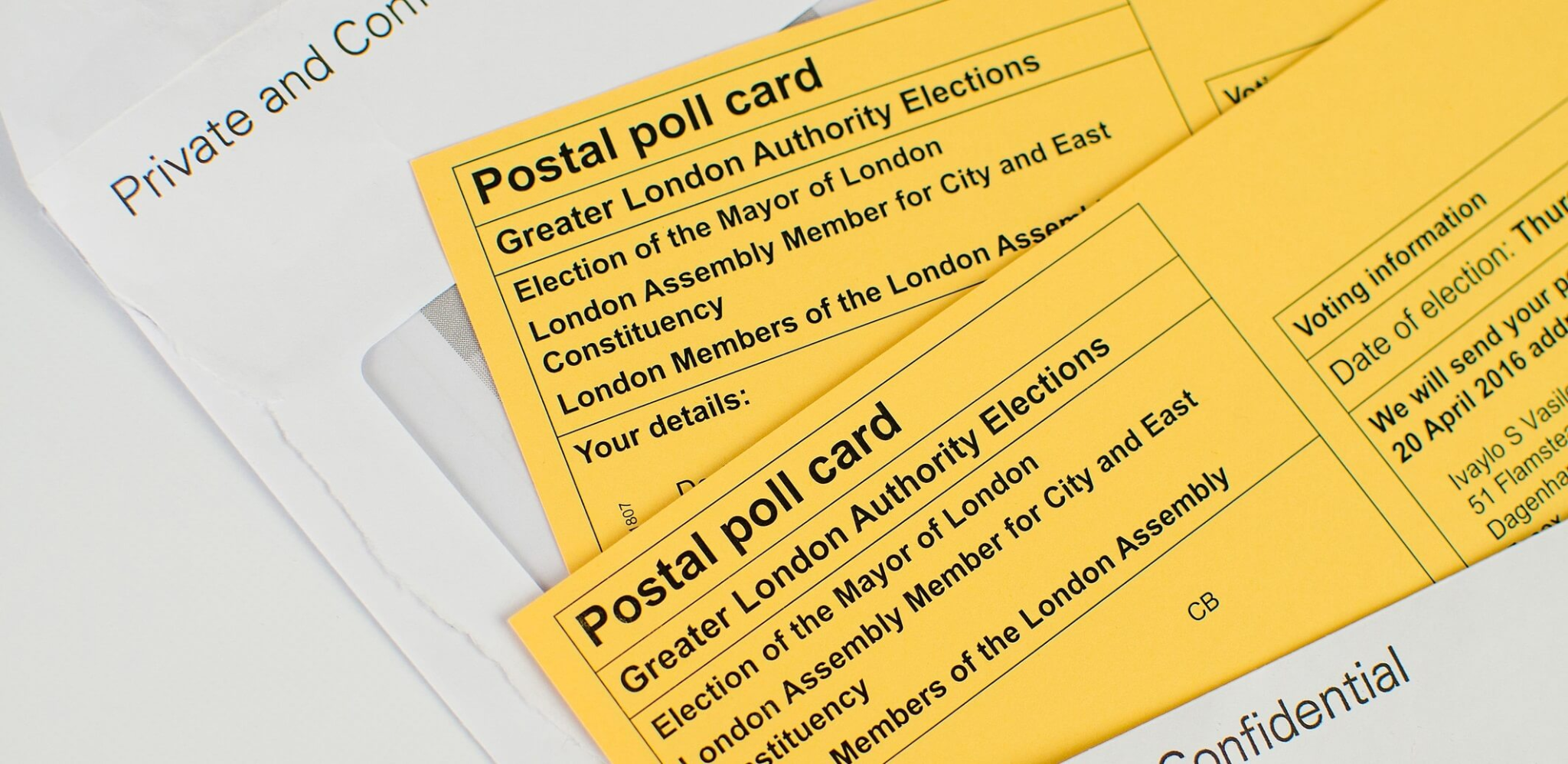

First and foremost, what exactly is a credit rating? It’s a score that a credit reference agency uses to show how well you deal with credit. The rating you have is affected by how many debts you have, whether you repay them in a timely manner as well as factors such as whether you are on the electoral roll. It is easy to find out your rating, simply create an account with a credit reference agency website such as Experian. They will produce a report that banks or mortgage companies will be able to review before considering lending to you for your property purchase. If your rating is high, that’s great! Mortgage companies are more likely to be able to offer you a wider range of products with better interest rates. If your rating is lower, however, there are things you can do to bring it back up again.

Why is your credit rating important?

A mortgage is probably the biggest financial commitment most people make in their lives, it can last for up to 35 years, so it is essential that you obtain the best interest rate possible. If you have a good credit rating, you will hopefully be able to access all the current best interest rates on the market, depending on the size of your deposit and your affordability.

So, if you’ve found a home you want to purchase and you have an appointment with a mortgage advisor, will they be checking your credit rating straight away? The answer is yes, when they are putting together your agreement in principle, the lenders they apply with will run a ‘soft’ credit search on you that will not show up on your credit file. When you decide to make a full mortgage application, the mortgage lender will run a ‘hard’ check on your file, which will leave a notification that you have applied for a mortgage. If you need conveyancing Hemel Hempstead or elsewhere, firms such as Sam Conveyancing can provide a wealth of advice and help throughout the entire process.

Keeping Score

If your credit rating has come out at a lower level than you were expecting, there are ways to help restore it to a better level. First, make sure you are on the electoral roll at your current address, this is a simple process that you can do online. Next, make sure you are a bill payer for at least one of your utilities, such as gas or electricity. Finally, get a credit card that you use frequently and that you pay off in full every month. Also, go through all your previous borrowing commitments, it is easy to forget about a long-ago used credit card that you may have forgotten to clear.